Raising the Bar on Revenues and Loyalty With Buy Now, Pay Later Solutions

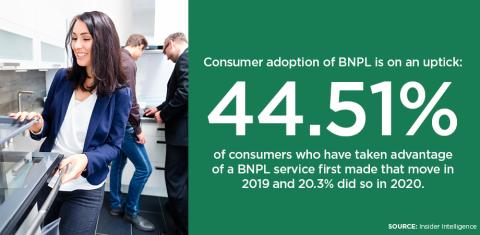

The “buy now pay later” (BNPL) model — also known as the “pay-over-time” model, is seeing consistent growth as consumers seek new means of financing their purchases. According to a report by Insider Intelligence, 44.51% of consumers who have taken advantage of a BNPL service first made that move in 2019 and 20.3% did so in 2020.

BNPL offers a wealth of advantages to retailers, including the ability to increase consumers’ motivation to upgrade their purchases with the option to make a series of smaller, more manageable payments for the items they want rather than pay in a larger lump sum. Giving consumers the option of BNPL financing also allows retailers to appeal to a wider breadth of consumers who may not otherwise shop in their stores, as well as to cultivate strong customer loyalty. All of this adds up to a better bottom line.

Read on to find out more.

A millennial couple goes shopping for a sectional couch at a big-box furniture store. They find a piece they really love — one that is made of very high-quality leather and has features like adjustable footrests and an integrated table that pops up and retracts as needed. However, the price is too steep for the couple to bear and they tell the salesperson they must settle for a less expensive couch without bells and whistles. The salesperson says he understands, then present an alternative: buying the “better” couch and paying for it in increments over a period of 60 months. Almost immediately, the couple agree — and the sale is made, helping to bolster the retailer’s short-term revenues.

Meanwhile, another couple wants to buy a state-of-the-art home theater system, but their monthly budget precludes purchasing it up front and they don’t want to put it on their credit card. But instead of delaying their purchase, they arrange to handle the purchase in interest-free installments — and the couple decides that from then on, they will make all their electronics and appliances purchases at the store from which they bought it.

Scenarios like these are becoming increasingly common as the “buy now, pay later” (BNPL) or “pay-over-time” model takes hold. Under this umbrella, merchants offer a point-of-sale (POS) loan at checkout, through a partnership with a financial institution or fintech. The loan is then repaid on a set schedule (usually monthly), at interest rates that range from 0% to 30%, according to a 2020 BNPL market report by Coupon Follow.

Growth and More Growth

Statistics show significant growth in the BNPL segment, particularly over the past two years, as well as ongoing growth going forward. A report by Kaleido Intelligence estimates the BNPL industry as racking up $680 billion in transaction volume in 2025, representing a 92% increase over the $353 billion worth of BNPL transactions recorded in 2019. A recent report from Insider Intelligence contains an identical forecast. “Buy now, pay later solutions are continuing to grow in popularity as people seek alternative methods of financing,” the authors write.

Additionally, BNPL usage by customers is on an uptick. According to Insider Intelligence research, 44.51% of consumers who have taken advantage of a BNPL service first made that move in 2019 and 20.3% did so in 2020. However, only 7.42% of current BNPL users had signed up for a “pay-over-time” plan prior to 2015.

“The market is set to see further development,” with retailers that do not consider implementing a BNPL solution placing themselves at a competitive disadvantage, Steffen Sorrell, Kaleido’s chief of research, stated in the report.

A few catalysts are at work here. For starters, an increasing number of consumers want the flexibility to make larger purchases in a responsible manner, often without a credit card. In the Insight Intelligence study, a desire to avoid paying credit card interest was the most common reason for using BNPL, with 39.37% of respondents citing it.

COVID-19 has also upped the BNPL ante. Financial difficulties brought on by the pandemic have forced some consumers to look for more flexible, palatable payment methods. Of Coupon Follow survey participants who now use BNPL, 66% of GenZ consumers and 56% of millennials tried it for the first time due to COVID-19.

What’s more, BNPL is becoming “table stakes” for retailers, with many making it available online and some offering it online and in-store. According to Forbes, it has not only reached the “table stakes” stage, but has become an inflection point, with many retailers implementing pay-over-time options.

BJ's Wholesale Club falls on the list of these retailers. In early 2021, the membership warehouse club operator announced that it had partnered with Citizens to provide its members the option to make large purchases, such as television sets, appliances and home furnishings, via Citizens’ new Citizens Pay offering. Using Citizens Pay, BJ’s members can tap into a line of credit online, then use it for repeat purchases without a new credit application or the need to procure multiple loans.

Citizens Pay is available for orders placed on BJ’s website for delivery, as well as for buy online, pickup in club and curbside pickup. BJ’s will expand the partnership to include financing for in-club purchases completed on its mobile app during second-quarter 2021.

Such heavy-hitters as Gap, GameStop, Macy's, Neiman-Marcus and Walmart rank among other merchants and brands that have boarded the BNPL train. Moreover, under a partnership with Citizens, manufacturers like Apple and Microsoft give consumers the option of BNPL financing when they buy such products as online games at a variety of retailers. Best Buy, GameStop, Target and Walmart, for example, offer a Citizens financing solution on Microsoft’s Xbox All Access. Citizens has also expanded its partnerships into other categories, including health and fitness, educational products and services and home improvement.

Cultivating a Customer Base

The growth of BNPL is not surprising, given the big benefits it delivers to retailers. For example, it lets merchants appeal to a wider base of customers than ever before, in turn increasing their sales. One reason this is so: BNPL gives consumers the opportunity to upgrade to premium versions of the items they want and save cash by making smaller payments over time. BNPL is also a more flexible, modern method of payment, featuring low monthly installments and, depending on the merchant, an interest rate of 0% or close to it. In short, it’s a powerful purchase-motivator.

Research underscores just how strong such motivation can be. According to an internal survey conducted by Citizens, 76% of consumers are more likely to make a purchase “if a payment plan, backed by a seamless point-of-sale experience, is offered” to them. Forty-five percent of respondents to the survey noted that the ability to finance a purchase influenced their decision of whether to go ahead with it.

But this is just the tip of the iceberg. BNPL also boosts conversion rates, extending retailers’ customer reach by saving the sale. It gives consumers an alternative to leaving online or bricks-and-mortar stores empty-handed because their current budget won’t accommodate the purchase they wish to make. The very availability of BNPL has much the same effect: With it in place, retailers can attract the attention of customers who may avoid certain stores based on the belief that they cannot afford to shop there.

Again, numbers tell the tale: Roughly one-third of participants in the Citizens Point of Sale survey claimed they would not have made a purchase “without buy now, pay later lending.” So, too, did nearly half (48%) of participants in a global survey by BigCommerce. Of consumers queried for the Insider Intelligence report, 38.4% said BNPL services enabled them to make purchases they would otherwise have been forced to forego because of budgetary constraints.

Revving Up Revenues

Retailers that launch BNPL solutions also see increased revenue streams. Not surprisingly, many consumers spend more money when they can spread out payments over time — for instance, choosing the luxury version of an item instead of its moderately priced counterpart. Many buy multiple items — for example, a living room set instead of just a couch — in a single online or in-store shopping session. The end-result is higher revenues.

These revenue increases can be significant given the impact of BNPL on transaction size. According to a surveyby Cardify, a data firm that tracks consumer spending, nearly half of consumers spend anywhere from 10% to over 40% more when they tap into a BNPL plan versus when they use a credit card. Citizens’ internal research indicates that the pay-over-time option can increase the value of each transaction by 25% to 40%. About 20% of individuals polled for the study said they typically use BNPL options to finance purchases of $1,000 or higher.

Then, there are long-term revenue gains. The positive, upgraded shopping experience enabled by BNPL — brought to the table by a fully digital alternative to unwieldy, one-time payments — creates loyal customers and repeat business. Once consumers have shopped at a retailer’s website or in one of its stores and taken advantage of BNPL, they will be more likely to return to that website or store than to patronize the competition. Additionally, upon learning that the merchandise they want or need is available from a retailer with a BNPL plan, most consumers stop shopping around and buy it from that merchant. All of this leads to a consistently healthier bottom line.

The End Game

Credit cards and other payment instruments have their place in retail. However, retailers would do well to explore adding pay-over-time solutions to their POS toolbox. BNPL is, and will continue to be, a powerful competitive weapon and a linchpin for cultivating enduring relationships with customers while fostering growth.