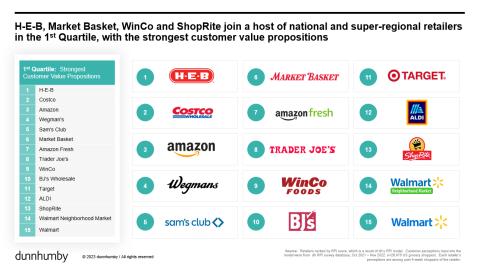

Top Preferred U.S. Grocery Retailers 2023

H-E-B moved into the No. 1 spot and Costco took No. 2, as the top U.S. grocery retailers on the dunnhumby Retailer Preference Index (RPI) this year.

The two grocers bumped Amazon from its leadership position last year, down to third place. Wegmans took the fourth spot for the third year in a row.

The sixth annual RPI polled 10,000 U.S. households to evaluate 63 retailers. The overall RPI rankings are the result of a statistical model that predicts how retailers execute on five drivers of the value proposition: Price, Promotions, and Rewards; Speed and Convenience; Quality; Digital; and Operations.

This year, dunnhumby analyzed survey data from an additional 20,000 consumers surveyed in October 2021 (10,000 consumers) and May 2022 (10,000 consumers) and combined that data with the November 2022 poll of 10,000 consumers.

“In 2017 we set out on a journey to understand how customers’ preferences and retailers’ financial results predicted which retailers would last,” said Matt O’Grady, dunnhumby's president of the America’s. “But little did we know that in the ensuing six years consumers and retailers would have a lifetime of difficulties including a pandemic that shook consumer behavior and the global economy, a prolonged period of supply change struggles, and a once-in-a-generation inflation crisis. We believe this report can serve as a blueprint to help grocers improve their competitive positions, while providing key findings for marketing and consumer preferences.”

The 11 additional retailers with the highest overall customer preference index scores are: 5) Sam’s Club, 6) Market Basket, 7) Amazon Fresh, 8) Trader Joes, 9) Winco, 10) BJ’s Wholesale, 11) Target, 12) Aldi, 13) Shoprite, 14) Walmart Neighborhood Market and 15) Walmart.

The full RPI report can be downloaded today.

Top 15 Grocery Retailers With the Strongest Customer Value Propositions, out of 63 Total Retailers

Key findings from the study:

- BJ’s Wholesale was the biggest mover in the RPI over the last three years, climbing from 27th place to 10th place in 2022, a 17 -point jump in rankings. Schnucks climbed 16 spots and currently sits in the 2nd Quartile overall. Other big ranking movers not in the first Quartile overall but improving were: Food Lion (14 spots up), Food4Less/FoodsCo (12 spots up), Weis (10 spots up) and Food City (9 spots up). These five retailers have two things most in common: they displayed superior ability to navigate supply chain issues by improving their ranking in the Operations pillar, which measures out-of-stock perceptions among other things, and they have existing strengths or made significant gains in their competitive position on saving customers money.

- Fierce battle at the top between U.S. grocers. In 2020 and 2021, the pandemic helped propel and then solidify Amazon as the top grocery retailer over H-E-B, Trader Joe’s and Wegmans, since Amazon’s value proposition excels at both saving customers time and providing a seamless e-commerce experience. But in 2022, H-E-B reclaimed the top spot due to their superior ability to deliver a combination of better savings and better-quality experience/assortment.

- Digital has staying power but is no longer as key to driving short term retailer momentum as it was from 2020-2021. The pandemic increased the percentage of Americans shopping online for groceries from 39% to 50% of the country — an 11-point rise — and, despite record inflation, over half of those people remained online grocery shoppers in 2022. As a result, there are 9.4 million more omnichannel households today than there were in 2019 with a combined grocery budget of $4.9 billion.

- Retailers in the top quartile outperform the rest of the market in delivering superior customer benefits, savings, or both. Top quartile retailers have an average compounded average growth rate (CAGR) of 7.3% compared to third quartile retailers with a 3.2% CAGR. In addition, 59% of customers of first quartile retailers have a strong emotional connection with retailers compared to 45% of customers of third quartile retailers.

- Amazon is still superior in online shopping, but all other online retailers are closing the gap. In fact, 52% of customers of first quartile retailers reported they have an easy online shopping experience, an increase of 13% from 2019. The top six retailers for digital are 1) Amazon, 2) Amazon Fresh, 3) Target, 4) Sam’s Club, 5) Walmart, and 6) Walmart Neighborhood Market.

- Club stores are gaining momentum with three of the top 10 spots in the first quartile now occupied by club stores. Costco (2), Sam’s Club (5), and BJ’s Wholesale (10) achieved a high rank through a combination of top-notch dependability and saving customers money while delivering a seamless experience. In dunnhumby’s 2019 RPI, no club store ranked higher than seventh.