Buy Now, Pay Later vs. Traditional Store Financing: A Retail Primer

Until recently, private-label credit cards, layaway and, in the case of large retailers, co-branded credit cards were the only “in-house” financing options merchants could offer to consumers. However, an alternative to these options — buy now, pay later (BNPL), also known as pay-over-time — is not only available, but is catching on fast with merchants and consumers alike. When deciding whether to introduce a BNPL program in addition to or instead of traditional card-based financing and find the right solution for their business, retailers must consider the demographics and preferences of their customers. Once they have opted to move ahead with BNPL, they must also follow a strategic approach to structuring and promoting their program if they are to achieve the best results from their efforts.

Read on to find out more about how to determine if BNPL is the right path for your business and how to best board the BNPL train.

Private-label credit cards. Layaway. And in the case of the largest merchants, co-branded credit cards.

Until recently, these were the only “in-house” financing options retailers offered to consumers. However, the tide is turning with the increased availability of "buy now, pay later" (also known as "pay-over-time") programs. In a BNPL scenario, merchants team up with a financial institution or fintech to provide consumers with point-of-sale (POS) loans at checkout — online, in-store or both. Consumers then repay their loan on a set schedule (usually monthly).

But when should retailers choose to introduce BNPL instead of or in addition to traditional card-based financing? How should merchants promote such a program?

“Those are questions that every retailer should ask when thinking about the right solution for their business, and their customers,” says Matt Norton, senior vice president and head of business development, Citizens Pay. Citizens Pay works with retailers to deliver tailored BNPL programs built around a virtual line of credit, with a wide array of product solutions and repeat purchases that don't require without additional credit applications.

Critical Considerations

Retailers should first look at customer demographics and interest in credit card offerings when weighing whether BNPL would be the right financing solution to resonate with and meet the expectations of their consumer base. “It’s about experiences and customer preferences,” Norton says.

Many consumers want the option to pay for their purchases over time, but would prefer to avoid adding another credit card to their wallet. Twenty-five percent of respondents to a March 2021 survey conducted by The Ascent, a personal finance service of financial and investment advice firm The Motley Fool, said they want BNPL to replace their credit cards.

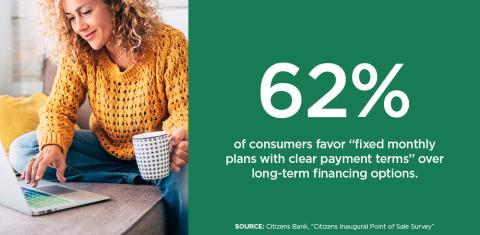

Similarly, according to Citizens’ Inaugural Point of Sale Survey, 62% of consumers favor “fixed monthly plans with clear payment terms.” Two-thirds (66%) of consumers feel that they have enough credit cards and prefer not to open more just to make a big purchase.

Millennials and “bridge millennials” (individuals in their late 30s and early 40s) are likely the strongest target for BNPL, no matter the type of retailer. “Consumers ages 22 to 44 are less likely to respond to credit card offers,” Norton asserts. “Either they want something digital, or they don’t like the idea of another piece of plastic. They see BNPL as their best solution."

According to a study conducted in late 2020 by PYMNTS.com, millennials have demonstrated “remarkable” interest in BNPL solutions, regarding pay-over-time programs not as a last resort, but rather as “part of an array of credit tools they can access.” Individuals in this demographic group are said to lead in early adoption of BNPL, especially older “bridge millennials” with more purchasing power than younger consumers. The research also showed that 38% of millennials who had not turned to BNPL in the past year were highly interested in using it in tandem with digital wallets, and that 11.5% of bridge millennials have used BNPL, “close to double the average.”

Customer spending patterns, too, merit consideration by retailers as they formulate decisions about BNPL adoption. “Retailers that offer a credit product for everyday purchases, with lots of small-ticket spend, could look at BNPL as a solution for financing big-ticket items,” Norton explains.

On average, findings of a BNPL market report by Coupon Follow indicate, home and garden purchases (like furniture and home decor) completed with BNPL total $1,187, followed by consumer electronics ($629) and beauty and health ($249). About 20% of individuals polled for the study said they typically use BNPL options to finance purchases of $1,000 or higher.

In another vein, retailers would do well to assess the full value proposition offered by BNPL in determining whether it will work for them. As RIS Newspreviously reported, adding a pay-over-time program to the POS toolbox enables retailers to increase consumers’ motivation to upgrade their purchases, attract a wider breadth of customers who may not otherwise shop in their stores, and cultivate strong customer loyalty — all of which bolster the bottom line. However, there is more to the story than this.

Specifically, although BNPL programs entail monthly payments, retailers collect the total payment for consumers’ purchases up front. The financing entity assumes risks associated with repayment. In addition, with BNPL, deferred interest — which can cause consumers to have a large amount of interest tacked onto their loan unexpectedly, in turn leading to a poor customer experience and customer attrition — does not come into play.

“Transparency and trust are important to consumers,” Norton stated. “They want to upgrade their purchases with predictability and the confidence to shop knowing exactly how much they will owe, without any surprises.”

Promotion Imperatives

While BNPL offers advantages over traditional in-house financing options and can be a better fit for retailers under some circumstances (e.g., they cater primarily to a younger customer base), capitalizing on its benefits and appeal necessitates a strategic approach to promotion. Otherwise, it may be difficult for retailers to realize the full potential and appeal of a digital pay-over-time program.

Touting the availability of BNPL as early in the shopping journey as possible is paramount. For online retailers, this means showcasing the opportunity to pay for purchases over time in multiple places on every product page, alongside descriptions of the merchandise and any other pertinent information. Statistics appear to underscore the value of such an approach: According to a report by McKinsey & Company, integrating BNPL into the pre-purchase phase of the consumer journey as opposed to only at checkout doubles or triples conversion rates, and 75% of consumers decide to finance purchases at the start of the purchasing journey.

“This is really where you’re influencing the buying decision,” Norton says. “Suppose a consumer is shopping for furniture online and sees an item she likes with a price tag of $1,200, but she would rather not pay for it all at once or put it on a credit card and worry about how long it will take to pay off. She will be more likely to continue shopping if she sees that she could buy that item for $50 per month for 24 months."

Consumers should also be given the opportunity to view the details of a BNPL option and to apply for pay-over-time financing on the checkout page rather than by clicking a link to a separate section of the website. Retailers that follow this strategy experience a significant increase in conversion lift and a higher order value, along with marked decreases in cart abandonment rates, Norton states.

This is good news for retailers given the prevalence of cart abandonment: An e-commerce checkout usability study by the Baymard Institute reveals that the global shopping cart abandonment rate currently stands at 69.8%. This figure reflects the average of shopping cart abandonment statistics from 44 different studies examined by Baymard’s researchers.

Additional findings from the study make an even stronger case for ensuring a frictionless BNPL checkout experience by incorporating program information and application steps into the checkout page rather than forcing consumers to click a link to yet another webpage. Slightly more than three-quarters (76%) of consumer participants in the Citizens Point of Sale Survey reported that they are more likely to make a retail purchase if a payment plan is “backed by a simple and seamless point of sale experience.”

Moreover, 23% of consumers queried by Baymard cited difficulty in completing the checkout process as their primary reason for abandoning their online shopping cart. By contrast, its researchers found, the average e-commerce site can achieve a 35.26% increase in conversion rates — and boost sales by up to $260 billion — solely by streamlining the design of its checkout page.

Going the extra mile to promote BNPL is equally critical for retailers that want to reap the benefits of offering pay-over-time BNPL in physical stores instead of or as an adjunct to long-term financing. Displaying descriptive signage and collateral materials with QR codes shoppers can scan with their smartphones to learn more about BNPL works well here. So, too, do sending “calls-to-action” to customers via text and configuring the program so shoppers can use any mobile device to easily apply for BNPL on the spot from anywhere in the store.

BNPL can also be positioned as an attractive financing option for consumers who do not qualify for private-label credit cards because they have no credit or have a poor or fair credit score. Consumers like the fact that some BNPL programs that require payments every two weeks afford them the flexibility of a higher spending limit without a credit check (and the risk of being declined for credit). Twenty-five percent of respondents to a survey by Cardify, a data firm that tracks consumer spending, said they tap into pay-over-time for this reason. An additional 14% gravitate to BNPL because they already know that they cannot be approved for a traditional credit card.

The Upshot

Any decision to implement BNPL must be well thought out and based on customer needs and expectations, with close attention paid to individual retailers’ target markets as well as to other factors. Concerted efforts need also be made to show the value that BNPL can deliver at the product level and to foster a friction-free process for users. Retailers that follow these tenets should have no difficulty achieving success as they add a pay-over-time option to their POS arsenal.