Bank Partner or Fintech Partner: Which is Retailers’ BNPL Best Bet?

There is no question that the buy now, pay later (BNPL) or pay-over-time model holds significant appeal for retailers. But just as they must investigate many issues when deciding whether BNPL is the right solution for them, merchants must determine whether to launch such a program in partnership with a bank that has its own BNPL product and program or ally with a fintech.

Making an informed decision means understanding the difference between the two types of partners, and the more retailers know about what banks and fintechs bring to the table for BNPL, the greater the likelihood their program will meet their needs and the needs of their customers.When it comes to BNPL programs and products, the array of options available to retailers tops the list of key differentiation points between banks and fintechs. Another differentiator centers on BNPL parameters, such as terms and rates as well as loan amounts.

Read on for a deep dive into these critical issues.

Choosing a BNPL Partner: Bank or Fintech?

“Offering a ‘buy now, pay later’ (BNPL) option will definitely benefit our retail operation. But should we do so by partnering with a bank that has its own BNPL product and program, or by teaming up with a fintech that brings the technology and access to third-party lenders?”

That’s the key question retailers should ask before boarding the BNPL train. Making an informed decision means understanding the difference between the two types of pay-over-time program partners.

“The more retailers know about what banks and fintechs bring to the table for BNPL, the better positioned they’ll be to meet their goals and the needs of their customers,” says Matt Norton, senior vice president and head of business development for Citizens Pay, Citizens’ BNPL offering.

Varying Product Options

When it comes to BNPL programs and products, the array of options available to retailers tops the list of key differentiation points between banks and fintechs. Fintechs typically offer one set “flavor” of BNPL product, based on the parameters set by the funding partner with which they themselves have teamed up to finance the POS loans consumers can repay over time. Choosing the fintech path may be a viable option for merchants that do not want or have the need to tailor a pay-over-time program to their specific requirements.

By contrast, some banks are becoming end-to-end custom BNPL solution providers. Consequently, a bank with its own funding source can tailor pay-over-time products to the needs of individual merchants. For example, banks can customize when and how BNPL offers are presented to consumers online. They can also give retailers a choice when it comes to integration: a fully integrated solution using APIs, a hosted BNPL solution with no integration necessary, or a combination of the two. The upshot, according to Norton, is more all-around control for merchants.

Another differentiator centers on BNPL parameters, such as terms and rates as well as loan amounts. For example, Citizens Pay offers loan terms from three to 60 months depending on the purchase size, and loans up to $20,000 and higher depending on the industry.Retailers that work with a fintech to execute their BNPL program become part of a “pooled” merchant portfolio maintained by that fintech’s point of sale (POS) lender partner. As a result, they have little flexibility when it comes to such elements as loan terms and maximum purchase amounts. Banks that have access to their own lending funds can offer programs across the full spectrum and treat each retailer individually, again affording retailers more control over their own BNPL program, according to Norton.

“Banks can offer longer lending terms and bigger ticket sizes, as a general rule,” he states. “Lower rates, more control, more flexibility."

A report from McKinsey & Company sheds light on the importance of flexibility in BNPL lending. “Initially, POS loans mostly targeted lower-prime or higher-ticket segments, such as those seeking a loan for home remodeling,” the authors write. “Today, however, newer entrants are displacing credit card spending more directly. Purchasers with ticket sizes as low as $200 to $300 are shifting to shorter-tenure (four- to six-week) POS financing.”

The authors also point out that POS loans of less than $500 are growing at rates exceeding 40 to 50%, and that more premium merchants now offer financing from POS financing providers at 0% APRs. These services, along with a seamless application experience, are beginning to attract prime customers.

Technology Differences

Possible differences between the technology platforms that power fintech-enabled BNPL and those that power bank-enabled BNPL should also be considered as retailers begin to plot their pay-over-time course. Most banks have added an installment lending/BNPL component to their credit card platforms, while fintechs have designed their platforms specifically for the purpose of BNPL lending. Citizens has taken a different approach, more like the fintechs, designing a platform that is purpose-built for BNPL. Purpose-built platforms potentially remove checkout friction from the equation, helping retailers to deliver the friction-free checkout experience consumers have come to expect.

Results of the Citizens Inaugural Point of Sale Survey, an internal research initiative by Citizens, underscore the importance of seamlessness at the POS. Seventy-six percent of respondents said a payment plan “backed by a simple and seamless point of sale experience” would increase their inclination to make a retail purchase.

Best Practices

Helping retailers to get more out of offering pay-over-time options is a priority for some banks, including Citizens. These banks partner with merchants to ensure this outcome, using a framework of best practices along the way. The first step entails leveraging open lines of communication — discussing retailers’ needs and goals and the needs and goals of their customers. This ensures that the end-product — i.e., the BNPL program — is configured to meet all expectations, from both the merchant and customer perspective.

“For example, we’ll look at where in the purchase journey customers will be made aware of the BNPL program and the best ways to prevent friction from being introduced into the shopping experience,” Norton says. “We’ll explore product options where the duration of the loan and the APR structure are concerned, partially because a higher APR increases the cost to the customer, and because promotional interest-free offers have an impact on the retailer.

“A higher APR, of course, doesn’t always work. As an example, an APR of 24% is okay if a customer is buying a sweater, but the interest there could be prohibitive if a customer is buying a new TV.”

Norton adds that Citizens applies six years’ worth of POS financing experience in developing retailers’ BNPL programs. Most banks do not have any historical expertise in this space, and those that do have been focused primarily on private label store card programs.

“We focus on transparency and customer experiences built around predictable monthly payments without any friction,” Norton explains. “Traditional bank offers made via store cards most often have deferred interest. That penalizes consumers who don’t repay the full amount during a promotional period — by tacking all of the interest onto their balance from day one.”

Reputable bank partners like Citizens take an active role in designing the BNPL program so that financing is promoted early in the purchasing journey, in turn maximizing conversion rates. Overall, they will also take steps to eliminate or decrease the number of points during that journey where customers can be lost before the transaction is completed.

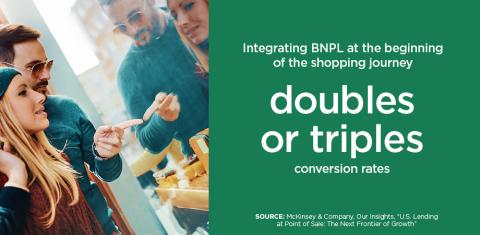

Such cooperation is essential. An e-commerce checkout usability study by the Baymard Institute estimates the current global shopping cart abandonment rate at 69.8%. Additionally, a report by McKinsey indicates that integrating BNPL at the beginning of the shopping journey doubles or triples conversion rates.

Just as significantly, it is important that retailers actively monitor BNPL outcomes with their financing partner, reviewing shared data and analytics to grow and optimize the program. “More communication and collaboration lead to increased acceptance rates and increased utilization,” Norton says. “They also drive more consumer usage and spend.”

The Future

Partnering with a bank, rather than with a fintech, to launch and maintain a BNPL program is an option well worth considering by most retailers. Moreover, merchants that work in tandem with their bank partners throughout the life of their pay-over-time offering stand the best chance to leverage that offering to its greatest advantage.

a9db.jpg)